AI Paradox Weekly #4: The Financial Engineering Era Exclusive (October 7-21, 2025)

- Home

- AI Paradox Weekly #4: The Financial Engineering Era Exclusive (October 7-21, 2025)

The AI Paradox Weekly

October 7th – October 21st

Table of Contents

TL:DR The Essential Intel

When you are pressed for time - and just need the goods

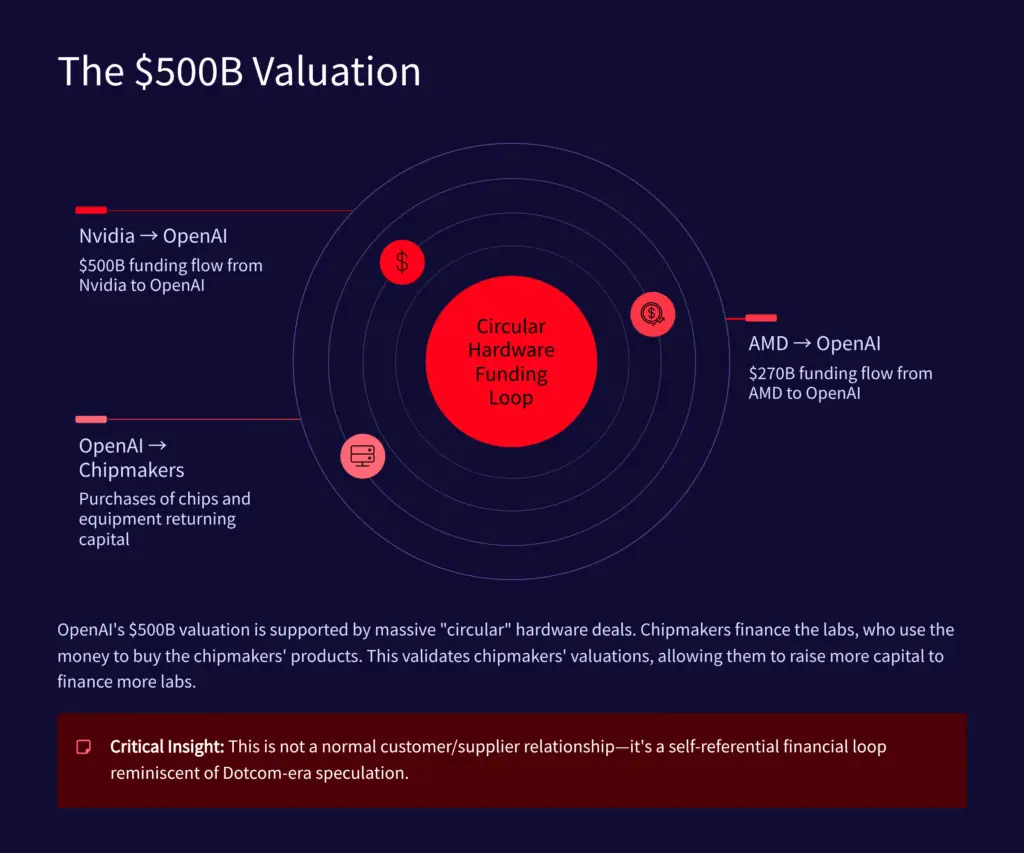

- OpenAI’s $500B valuation is supported by circular hardware deals worth potentially $770B from Nvidia and AMD. The AI infrastructure race is now financed by complex debt and asset-backed securities, not just equity. This creates a self-reinforcing financial loop where chipmakers finance the labs that buy their products.

- The Agent War officially began as Google launched Gemini 2.5 Computer Use on October 7 and Microsoft countered with SentinelStep on October 21. Google provided the “hands” (click, type, scroll). Microsoft provided the “persistence” (wait, monitor). The race is on to combine both into a single “Agent OS.”

- xAI secured $20B via a debt-financed SPV structure where Nvidia invests $2B in equity to finance xAI’s purchase of Nvidia’s own GPUs. The chips themselves serve as asset-backed collateral. This is the new blueprint for AI infrastructure financing.

- China’s counter-strategy emerged as DeepSeek launched V3.2-Exp with sparse attention architecture cutting inference costs by 50%. While US companies scale up with debt, DeepSeek competes on efficiency. The model works natively with Chinese chips, signaling supply chain independence.

- Anthropic pivoted from hiring to M&A, actively pursuing startup acquisitions after admitting their “safety-first, in-house-only” R&D model proved too slow. This creates a new exit market for AI startups and signals the beginning of industry consolidation.

- The application layer is winning with hyper-vertical SaaS. Fireflies.ai launched “Fireflies for VCs” with 17+ VC-specific AI apps. EvenUp raised $150M at $2B valuation for legal AI. The pattern is clear: general-purpose assistants are commodities; the value is in deep, workflow-specific agents.

Introduction: The Financial Engineering Revolution

The 14-day period from October 7-21, 2025, was defined by a seismic shift in how AI infrastructure gets financed. We’re no longer talking about traditional venture capital. We’re talking about trillion-dollar circular contracts, debt-financed special purpose vehicles, and “pedigree-premium” valuations for pre-product startups.

The market is bifurcating into two distinct layers: a capital-intensive “infrastructure” layer defined by complex financial engineering (OpenAI, xAI) and a high-growth “application” layer defined by hyper-vertical SaaS products that solve specific, high-value problems.

Simultaneously, the technical battleground moved from static model benchmarks to agentic capability. Google and Microsoft launched competing components for persistent, task-oriented AI. The agent war is no longer theoretical; it’s here.

And threading through everything: a geopolitical chess match where China’s DeepSeek offers an efficiency-first alternative to America’s scale-first approach.

Section 1: The Titans – Strategic Positioning and the Agent War

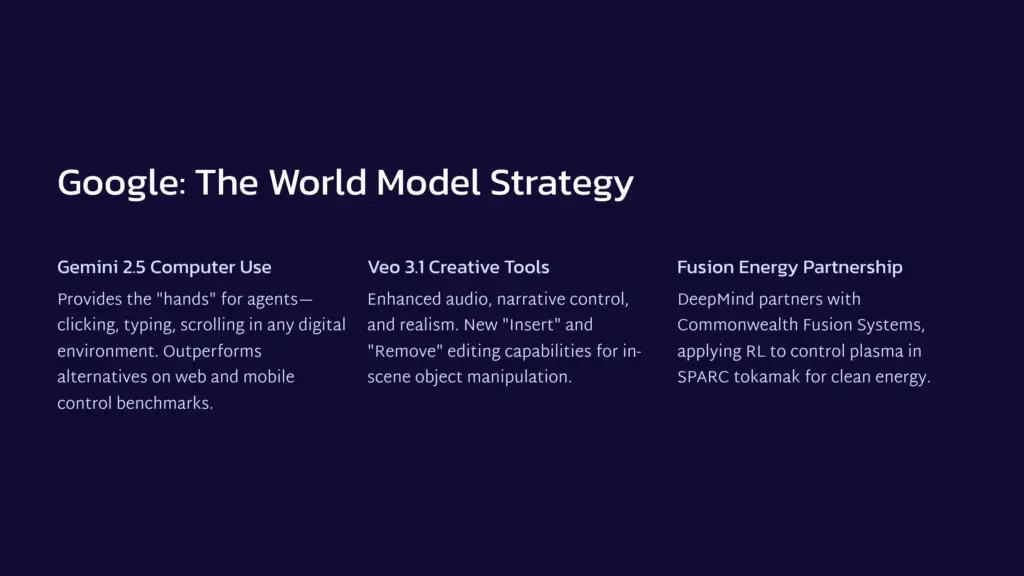

Google: The World Model Strategy

CATEGORY: Google Launches Gemini 2.5 Computer Use Model for UI-Based Agents

Source: Google DeepMind Blog | October 7, 2025

Key Details:

- Google announced the public preview of the Gemini 2.5 Computer Use model, built on Gemini 2.5 Pro and available via the Gemini API

- Explicitly designed to power agents that interact with user interfaces by clicking, typing, and scrolling

- Moves beyond API-only automation to enable AI that can act in any digital environment

- Reportedly outperforms leading alternatives on web and mobile control benchmarks while maintaining lower latency

Why Notable: This provides the “hands” for Google’s agent ecosystem. By enabling AI to interact with any UI, Google fired the starting gun on a new “Agent War.” An agent that can click and type in any application has the potential to replace the web browser as the primary computing interface.

CATEGORY: Google DeepMind Unveils Veo 3.1 with Advanced Creative Capabilities

Source: Google AI Blog | October 15, 2025

Key Details:

- Veo 3.1 introduces richer audio, enhanced narrative control, and improved realism

- The “Flow” filmmaking tool receives new editing capabilities: “Insert” (add new elements to a scene) and “Remove” (seamlessly delete objects)

- Existing features like “Frames to Video” and “Extend” now enhanced with audio support

Why Notable: This is the “imagination” component of Google’s World Model strategy. By adding audio and in-scene object manipulation, Google is building a true world simulator for the creative industry. Combined with Gemini 2.5 Computer Use, this signals an ambitious “embodied AI” strategy that masters digital action, creative simulation, and physical control.

CATEGORY: Google DeepMind Partners with Commonwealth Fusion Systems to Accelerate Fusion Energy

Source: DeepMind Blog | October 16, 2025

Key Details:

- The partnership aims to accelerate the timeline for clean, limitless fusion energy

- DeepMind will apply reinforcement learning to help control and optimize the plasma in Commonwealth Fusion Systems’ “SPARC” tokamak

- The collaboration leverages DeepMind’s “TORAX” plasma simulator to find efficient paths to net energy and discover novel, real-time control strategies

Why Notable: This provides the “physical control” element of Google’s strategy. It demonstrates AI applied to high-stakes, complex-physics problems—not just simulating the plasma, but using AI to control it in real-time. Together, these three announcements signal a coordinated three-pronged “World Model” push: digital action, creative generation, and physical world control.

Microsoft: The Persistence Play

CATEGORY: Microsoft Research Announces “SentinelStep” for Persistent, Long-Running Agents

Source: Microsoft Research Blog | October 21, 2025

Key Details:

- Microsoft Research introduced SentinelStep, a new framework for AI agents designed to enable agents to handle monitoring tasks that run for extended periods (hours or days)

- Manages when agents should check and their context, avoiding wasted resources and missed updates

- Examples include watching for specific emails, tracking price changes, and other “set-it-and-forget-it” workflows

Why Notable: This is Microsoft’s direct-fire response in the Agent War. If Google’s October 7 announcement provided the action (click, type), Microsoft’s SentinelStep provides the persistence (wait, monitor). A truly autonomous agent requires both capabilities. The market is now waiting to see which company can combine these two halves into a single, commercially-available “Agent OS.”

OpenAI: The Geopolitical Positioning Play

CATEGORY: OpenAI Details Disruption of Malicious AI Use

Source: OpenAI Global Affairs | October 7, 2025

Key Details:

- OpenAI has disrupted and reported over 40 networks since February 2024 that violated its usage policies

- Focus is on preventing AI use by authoritarian regimes for population control or coercion, as well as abuses like scams, malicious cyber activity, and covert influence operations

- Key trend observed: threat actors are integrating AI to increase the speed of existing playbooks, rather than using models to gain novel offensive capabilities

Why Notable: This announcement is a geopolitical positioning document. It establishes OpenAI’s role not merely as a technology provider but as a global security-governance body. By proactively self-policing and publishing these findings, OpenAI aims to build a “moat of trust,” justifying its central market position to regulators. This is a defense of its scale, framing its market dominance as necessary for global safety and stewardship.

Company Stage: Enterprise | Funding Status: $500B secondary valuation

Anthropic: The Consolidation Play

CATEGORY: Anthropic Strategically Pivots from “Hiring” to “Acquisitions”

Source: The Information (TITV) | October 16, 2025

Key Details:

- A report from The Information’s TITV program detailed a significant strategic change at Anthropic

- The company is reportedly moving away from its long-time focus on hiring specific, individual talent

- Anthropic is now actively pursuing M&A to acquire startup teams and their technology

Why Notable: This is a major signal of market consolidation and an admission that Anthropic’s “safety-first, in-house-only” R&D model is proving too slow to keep pace with competitors. It’s now more capital-efficient and faster to buy a high-performing, pre-built team than to poach and integrate individuals. This move effectively creates a new, motivated, deep-pocketed exit partner for AI startups, which will likely inflate valuations for “acqui-hire” targets in the AI safety and alignment space.

Company Stage: Enterprise | Funding Status: $183B+ Valuation

Section 2: The Foundation – Financial Engineering and Circular Economics

The $500B Valuation and Circular Financing

CATEGORY: OpenAI Valuation Hits $500B Amid Massive, “Circular” Hardware Deals

Source: Wolf Street & ETC Journal | October 10 & October 13, 2025

Key Details:

- OpenAI’s official valuation reached $500 billion based on secondary stock offerings

- This valuation is supported by massive, “circular” hardware deals. One report detailed a $100 billion AI chip deal between AMD and OpenAI

- Analysis characterized these as “hocus-pocus deals,” suggesting potential commitments of $500B from Nvidia and $270B from AMD

- OpenAI (which is “bleeding cash”) secures commitments from the same companies it buys equipment from

Why Notable: This is not a normal customer/supplier relationship. The AI labs and the chipmakers are financing each other. The chipmakers (Nvidia, AMD) finance the labs (OpenAI), who use the money to buy the chipmakers’ products. This validates the chipmakers’ high valuations, allowing them to raise more capital to finance more labs. This financial-engineering loop is critical to understanding the “AI mania” and draws direct parallels to the capital-heavy, speculative infrastructure build-out of the Dotcom bubble.

Company Stage: Enterprise | Funding Status: $500B Valuation

The $20B SPV Blueprint

CATEGORY: xAI Secures $20B via Debt-Financed, GPU-Backed SPV for “Colossus 2”

Source: The Information, Stocktwits, Breaking the News, FinancialContent | October 16, 2025

Key Details:

- Elon Musk’s xAI is reportedly raising $20 billion to fund its “Colossus 2” data center in Memphis

- This is not a standard equity round. It’s a complex Special Purpose Vehicle structured as $7.5 billion in equity and $12.5 billion in debt financing

- The SPV will buy Nvidia GPUs and then lease them to xAI, using the chips themselves as asset-backed collateral

- Nvidia itself is reportedly contributing $2 billion to the equity portion of this SPV, effectively financing its own customer

Why Notable: This deal is the new blueprint for the “circular” AI economy. Nvidia is directly investing in its customer to fund that customer’s purchase of Nvidia’s products. This locks in a multi-billion dollar sale for Nvidia, justifies xAI’s infrastructure scale, and uses Wall Street debt instruments (asset-backed leasing) to finance the entire loop. Welcome to the era of AI infrastructure financed by self-referential financial engineering.

Company Stage: Enterprise | Funding Status: $20B SPV in progress.

Section 3: The Vanguard – Counter-Strategies and Scientific Breakthroughs

DeepSeek: The Efficiency Alternative

CATEGORY: China’s DeepSeek Launches “V3.2-Exp,” Focusing on Efficiency

Source: BIIA | October 7, 2025

Key Details:

- Chinese AI startup DeepSeek released an experimental version of its model, DeepSeek-V3.2-Exp

- Introduces DSA (DeepSeek Sparse Attention), a new architecture designed for high efficiency

- This new architecture “cuts the cost of running the AI in half” compared to their previous V3.1-Terminus model

- The model is explicitly designed to work “right out of the box” with Chinese-made AI chips (Ascend, Cambricon)

Why Notable: This is a direct “asymmetric” counter-strategy to the US-led AI market. While US companies like OpenAI and xAI focus on scale (bigger models, bigger data centers) financed by complex debt, DeepSeek focuses on efficiency (cheaper models, sparse attention). This is a classic “disrupt from the bottom” play. A model that is 95% as good but 50% of the cost will win in the commodity and startup markets. The explicit mention of domestic Chinese chip compatibility shows this is a clear geopolitical and supply-chain-resilience strategy.

Company Stage: Scale-up

DeepMind: Autonomous Scientific Discovery

CATEGORY: DeepMind’s “AlphaEvolve” Achieves Autonomous Scientific Discovery

Source: ETC Journal | October 13, 2025

Key Details:

- Google DeepMind’s AlphaEvolve is an autonomous reasoning system that discovered new theorems in theoretical computer science

- The system operates without human proof design, using “self-evolutionary reasoning” to generate and mutate mathematical constructs until a verified proof is achieved

- This represents a breakthrough in “autonomous discovery,” transitioning AI from a tool for automation to a collaborator in knowledge creation

Why Notable: This is a clear example of the “AI for Science” track, where AI is used as an accelerationist tool to solve problems faster than humans can. AI is no longer just processing data; it’s generating hypotheses, conducting experiments, and discovering new knowledge autonomously. This moves AI from computational assistant to scientific collaborator.

Company Stage: Enterprise (Google/Alphabet)

Section 4: The Application Layer – Hyper-Vertical SaaS Dominance

This section analyzes the market movements and geopolitical landscape that provide the financial and legal context for the industry’s developments.

Fireflies.ai: The Hyper-Vertical Blueprint

CATEGORY: Fireflies.ai Launches “Fireflies for VCs,” a Hyper-Vertical AI Assistant

Source: Fireflies.ai Blog | October 8, 2025

Key Details:

- Fireflies.ai announced a new product launch specifically targeting a high-value niche: Venture Capital teams

- The product moves far beyond simple transcription to provide VC-specific, automated workflows

- Includes a library of 17+ “VC-specific AI Apps,” such as: Investment Memos (auto-generates deal memos), Founder Scorecards (rates founders on clarity, execution), Red Flags Detector, and Traction Tracker (extracts ARR, burn rate)

Why Notable: This is the blueprint for the next generation of all enterprise SaaS. It confirms the thesis seen in the funding rounds (EvenUp for Law, FurtherAI for Insurance). The “general-purpose assistant” is a low-value commodity. The real enterprise value is in “hyper-vertical” agents that understand the specific, high-stakes workflows of a single profession. Fireflies is building the “App Store” for meeting agents, and this is where the application-layer war will be won.

Company Stage: Scale-up

World A: The "Pedigree Premium" Funding Market

CATEGORY: “Pedigree Premium” Startup Reflection AI Raises $2B Series B at $8B Valuation

Source: HackerNoon | October 15, 2025 (reporting on week of Oct 5-11)

Key Details:

- Reflection AI (Brooklyn) raised $2 billion in a Series B at an $8 billion valuation, a 15-fold increase from its valuation just 7 months prior

- The founders are ex-Google DeepMind researchers Misha Laskin and Ioannis Antonoglou

- Investors include Nvidia (NVentures), Lightspeed Venture Partners, Sequoia Capital, and Eric Schmidt

- Mission: To be a Western, open-source alternative to closed labs and Chinese firms like DeepSeek

Why Notable: Reflection AI’s valuation is based almost entirely on the pedigree of its founders, as it has not yet released its first frontier model. This is a clear “pedigree premium” where investor capital flows to ex-DeepMind researchers before they’ve shipped a product. This is the “hype & pedigree” market where thesis-driven, high-risk, “world-changing” investments define the landscape.

Company Stage: Startup/Scale-up | Funding Status: $2B Series B

CATEGORY: Voice Interface Startup Sesame Raises ~$250M

Source: HackerNoon | October 21, 2025 (reporting on week of Oct 20-25)

Key Details:

- Sesame raised approximately $250 million at a valuation over $4 billion, led by Kleiner Perkins and Sequoia Capital

- An early version of its AI companion app became accessible to select iOS users starting October 21, 2025

- Sequoia’s investment thesis was cited as a bet on “voice becoming the next dominant computing interface”

Why Notable: This is a major “thesis-driven” bet, signaling that top-tier VCs are financing a fundamental shift in the human-computer interface. This isn’t just funding a product; it’s funding a vision that voice will replace keyboards and touchscreens.

Company Stage: Startup/Scale-up | Funding Status: ~$250M

CATEGORY: AI Data Center Crusoe Energy Systems Raises $1.38B Series E

Source: HackerNoon | October 21, 2025 (reporting on week of Oct 20-25)

Key Details:

- Crusoe Energy Systems raised $1.38 billion in a Series E at a $10 billion valuation

- Investors include Valor Equity Partners, Mubadala Capital, NVIDIA, Fidelity, and Founders Fund

Why Notable: This is a massive “picks and shovels” infrastructure play, demonstrating that capital is flooding into the physical data centers required to power the AI boom. Infrastructure providers are now commanding unicorn and near-decacorn valuations.

Company Stage: Scale-up | Funding Status: $1.38B Series E

World B: The "Vertical AI" Funding Market

CATEGORY: Legal-Tech AI Unicorn EvenUp Raises $150M Series E, Doubles Valuation to $2B

Source: Crescendo AI | October 7, 2025

Key Details:

- EvenUp (San Francisco) raised $150 million in a Series E led by Bessemer Venture Partners

- Its valuation exceeded $2 billion, more than doubling in under a year

- Provides AI workflows for personal injury law firms, including drafting demand letters and preparing case analytics

Why Notable: This is the healthy, traditional SaaS metrics world: solving a specific, high-value enterprise problem for a niche customer with a product that delivers clear ROI. EvenUp is not selling a vision; it’s selling working software that measurably improves outcomes for a narrow vertical. This is where real revenue and sustainable business models live.

Company Stage: Scale-up/Unicorn | Funding Status: $150M Series E

CATEGORY: YC Alum FurtherAI Raises $25M Series A for Insurance Automation

Source: Crescendo AI | October 7, 2025

Key Details:

- FurtherAI (San Francisco), a Y Combinator portfolio company, raised $25 million in a Series A led by Andreessen Horowitz

- The platform automates underwriting, claims, and compliance workflows for the $7 trillion insurance industry

Why Notable: Another hyper-vertical play targeting a massive, inefficient industry. Insurance is notoriously process-heavy and ripe for AI-driven automation. FurtherAI is building deep, workflow-specific tooling rather than a general assistant.

Company Stage: Scale-up | Funding Status: $25M Series A

CATEGORY: Data Analytics Startup Gravwell Raises $15.4M Series A

Source: Crescendo AI | October 21, 2025

Key Details:

- Gravwell (Minneapolis) raised $15.4 million in a Series A led by Two Bear Capital

- The company provides a full-stack data analytics and security platform for ingesting “ground truth” machine data from IT and OT systems

Why Notable: This is another infrastructure play, but focused on the data layer rather than compute. As AI systems scale, the quality and reliability of the underlying data becomes critical. Gravwell is building the “ground truth” layer for enterprise AI.

Company Stage: Scale-up | Funding Status: $15.4M Series A

Section 5: The Research Frontier – Academic Breakthroughs

Stanford HAI: AI for Neuroscience

CATEGORY: Stanford HAI Researchers Use Generative AI for Neuroscience

Source: Stanford HAI News | October 7, 2025

Key Details:

- Stanford researchers are using generative AI to create synthetic brain MRI technology

- This technology is “supercharging computational neuroscience” by generating massive, high-quality datasets to help researchers better understand brain diseases

Why Notable: Like AlphaEvolve, this is a prime example of the “AI for Science” track, where AI’s utility in simulation and data generation is unlocking new research pathways. AI is no longer just analyzing existing data; it’s creating synthetic datasets that would be impossible or unethical to generate otherwise.

Company Stage: Academic/Research

MIT: The Introspective Track

CATEGORY: MIT Reports Highlight LLM Political Perceptions and AI Labor Strategy

Source: MIT News | October 7 & October 21, 2025

Key Details:

- (Oct 7) An MIT study analyzed how 12 leading LLMs perceived the 2024 political environment by collecting over 16 million election-related responses

- (Oct 21) MIT Prof. Zeynep Ton warned that exemplary companies must shift from a “labor-as-cost-to-be-minimized” mindset to an “employee-as-driver-of-growth” strategy when implementing AI

Why Notable: These reports represent the “Science for AI” track. They are introspective, asking: “What is this tool doing to our politics?” and “How is this tool affecting our workforce?” The fact that these “accelerationist” (DeepMind, Stanford) and “introspective” (MIT) announcements occurred in the same 14-day window is a perfect snapshot of the dual-track state of AI development.

Company Stage: Academic/Research

Section 6: Developer Community and Open Source

GitHub: The Cookbook Era

CATEGORY: GitHub Trends Show Explosive Growth in Developer “Cookbooks”

Source: Medium | October 21, 2025

Key Details:

- anthropics/claude-cookbooks: Experienced “explosive growth” with +1,305 stars in one day, providing practical recipes for using the Claude API effectively

- PaddlePaddle/PaddleOCR: A powerful OCR toolkit, saw +713 stars

- x1xhlol/system-prompts-and-models-of-ai-tools: A collection of system prompts from major AI assistants, gained +233 stars

Why Notable: The center of gravity in the open-source community has shifted from building models to taming models. The cost of training state-of-the-art models has made it prohibitive for the community to compete at the foundation layer (with Meta’s Llama being the key exception). Therefore, innovation has moved up the stack. The “hot” repos are now “cookbooks” and “system prompt libraries.” This is a meta-layer of development, where the community is collectively reverse-engineering and fine-tuning the black boxes from closed-source companies.

HuggingFace: High-Velocity Incremental Research

CATEGORY: HuggingFace Papers Trends Show High-Velocity Incremental Research

Source: HuggingFace Papers | October 20, 2025

Key Details:

- A snapshot of HuggingFace Papers for a single day shows a high-velocity stream of incremental, specialized papers

- Top-voted papers included “A Theoretical Study on Bridging Internal Probability and Self-Consistency for LLM Reasoning” (144 upvotes) and “OmniVinci: Enhancing Architecture and Data for Omni-Modal Understanding LLM” (85 upvotes)

Why Notable: This demonstrates the rapid, daily pace of incremental optimization and theoretical work being shared openly, which runs in parallel to the major “breakthrough” announcements from large labs. The open research community is moving at breakneck speed, publishing and iterating daily.

Reddit: Local LLM Community Focus

CATEGORY: Local LLM Community Focuses on Practical Use and Llama 4 Anticipation

Source: Reddit r/LocalLLaMA | October 20-21, 2025

Key Details:

- The thread “Best Local LLMs – October 2025” gained 467 votes, indicating high community engagement in running open-weights models locally

- The discussion was structured to categorize models by specific use-cases: General, Agentic/Tool Use, Coding, and Creative Writing/RP

- A separate thread regarding “Llama 4” gained 263 votes, showing high community chatter and anticipation for Meta’s next major open-source release

Why Notable: The “Local” and “Open-Source” movement is not a hobby; it’s a parallel, decentralized R&D effort that is drafting off major tech-lab model releases. The high engagement shows a sophisticated “prosumer” and startup base focused on practical, hardware-accelerated applications. This movement acts as a direct check on the power of the closed-model giants. Meta’s open-sourcing strategy has made it the de facto “arsenal” for this movement.

Conclusion: Forward Outlook

The Three-Front War

This fortnight revealed an industry engaged in a three-front war:

1. The Financial Engineering Front OpenAI’s $500B valuation and xAI’s $20B SPV structure represent a new era where AI infrastructure is financed through circular contracts and complex debt instruments. Chipmakers finance labs that buy their chips. The chips themselves become asset-backed collateral. This self-reinforcing loop creates massive valuations and locks in multi-billion dollar sales, but it also introduces systemic risk reminiscent of the Dotcom bubble.

2. The Agent War Front Google provided the “hands” with Gemini 2.5 Computer Use. Microsoft provided the “persistence” with SentinelStep. The race is on to combine both capabilities into a single, commercially-viable “Agent OS.” The company that cracks this will fundamentally change how humans interact with computers—potentially replacing the web browser as the primary interface.

3. The Geopolitical Efficiency Front While the US builds bigger and more expensive infrastructure financed by debt, China’s DeepSeek offers an alternative: smaller, more efficient models that work with domestic hardware. This is asymmetric competition at its finest. A model that is 95% as good but 50% of the cost will win in the commodity market.

The Application Layer is Winning

Buried beneath the infrastructure headlines is a quieter story: the application layer is winning. Fireflies for VCs, EvenUp for legal, FurtherAI for insurance. These are not general-purpose assistants. They are hyper-vertical, workflow-specific agents that deliver measurable ROI to narrow customer bases.

This is where the sustainable business models live. The infrastructure layer may command the headlines and the trillion-dollar valuations, but the application layer commands the revenue and the customer relationships.

What Comes Next

The winners in the next 12-24 months will be:

- Companies that solve the agent “full-stack” problem (action + persistence + memory + UI interaction)

- Application-layer companies that dominate narrow, high-value verticals (not general assistants)

- Efficiency-focused model developers that can deliver 90% of the performance at 50% of the cost

- Infrastructure providers that can navigate the circular financing loop without collapsing under systemic risk

The groundwork for this new era was laid in these 14 days. The agent war is here. The financial engineering is unprecedented. And the application layer is quietly building sustainable businesses while the infrastructure players fight for trillion-dollar valuations.

Executive Summary & Governance Takeaways

The October 7-21, 2025 period marked a fundamental shift in the AI industry’s financial and technical architecture. Three major developments define this moment:

Financial Engineering Reaches New Heights OpenAI’s $500B valuation is supported by circular hardware deals where chipmakers finance the labs that buy their products. xAI’s $20B SPV structure uses the GPUs themselves as asset-backed collateral, with Nvidia investing $2B to finance its own customer. This self-referential financing creates massive scale but introduces systemic risk.

The Agent War Begins Google launched Gemini 2.5 Computer Use (the “hands”), and Microsoft countered with SentinelStep (the “persistence”). The race is on to build the first commercially-viable “Agent OS” that combines both capabilities. This represents a fundamental shift from conversational AI to autonomous, task-executing AI.

Geopolitical Competition on Efficiency While US companies scale up with debt-financed infrastructure, China’s DeepSeek competes on efficiency with sparse attention architecture that cuts costs by 50% and works natively with Chinese chips. This is asymmetric competition: the US bets on scale, China bets on efficiency.

Governance & Compliance Takeaways

Agent Autonomy = New Liability Surface Agents that can click, type, and operate autonomously across applications create fundamentally new liability questions. Organizations must review NIST AI RMF “GOVERN” functions and establish clear accountability frameworks that define human oversight boundaries, particularly for financial transactions, data access, and system modifications.

Circular Financing = Systemic Risk Concentration The financial engineering underlying AI infrastructure (circular contracts, debt-financed SPVs, asset-backed chip leases) creates concentration risk. Governance programs should assess vendor resilience, diversification strategies, and long-term viability. Reliance on a narrow set of suppliers whose valuations depend on mutual financing introduces tail risk.

Persistent Agents = Data Governance Challenge Microsoft’s SentinelStep enables agents that monitor systems for hours or days. This creates new questions about data retention, access logging, and audit trails. Organizations must ensure that persistent agents maintain complete activity logs, respect data minimization principles, and have clear termination protocols.

Hyper-Vertical Applications = Domain-Specific Compliance The rise of hyper-vertical AI applications (Fireflies for VCs, EvenUp for legal, FurtherAI for insurance) means compliance requirements are now sector-specific. A meeting assistant for VCs has different regulatory implications than one for healthcare. Governance frameworks must account for domain-specific regulations (HIPAA, SOX, SEC).

Pedigree-Premium Valuations = Due Diligence Gap Startups like Reflection AI commanding $8B valuations before shipping a product creates due diligence challenges. Organizations evaluating vendors must assess not just current capability but financial sustainability. High valuations based on pedigree rather than product create vendor risk.

Geopolitical Efficiency Competition = Supply Chain Resilience DeepSeek’s explicit compatibility with Chinese chips signals supply chain bifurcation. Organizations must assess geopolitical risk in their AI supply chain and consider multi-vendor strategies that don’t rely exclusively on US or Chinese infrastructure.

Bottom Line

The AI industry is entering an era where financial engineering, autonomous agents, and geopolitical competition converge. Organizations that:

- Establish clear agent governance frameworks (accountability, oversight, audit)

- Assess vendor financial sustainability beyond valuations

- Build multi-vendor strategies to mitigate concentration risk

- Implement domain-specific compliance for vertical AI applications

- Maintain supply chain awareness for geopolitical resilience

…will be best positioned to scale with compliance confidence, mitigate reputational and systemic risks, and build trust with regulators, partners, and customers.

The next trillion dollars of value will come not just from building autonomous agents, but from building responsible governance frameworks around them.

The past 14 days (October 22 – November 4, 2025) have been defined by a significant and coordinated strategic realignment among the industry’s largest players. The market’s focus has decisively pivoted from theoretical model capability to the commercial deployment of autonomous, enterprise-grade AI agents.

This shift was enabled and accelerated by three dominant, interlocking trends observed during this period:

1. The “Agentic Enterprise” Offensive: Market leaders, particularly Microsoft and OpenAI, launched a coordinated product offensive focused on “agentic” AI. This represents a move beyond simple chatbots to proactive, autonomous systems designed to execute complex business workflows, create applications, and manage high-value enterprise tasks.

2. The Great Compute Consolidation: A massive concentration of capital and strategic alliances solidified around key infrastructure providers. This was headlined by OpenAI securing a $38 billion cloud deal with Amazon Web Services (AWS), strategically diversifying its compute dependency beyond Microsoft. Simultaneously, NVIDIA’s GTC D.C. keynote unveiled a series of national-scale partnerships, positioning it as the full-stack, “sovereign AI” utility for entire industries and nations.

3. The Geopolitical “Trade Pause”: A significant, if temporary, de-escalation in the US-China technology trade war was finalized. This “trade reset” provides critical relief for the global AI supply chain, pausing US restrictions on tech exports and, crucially, Chinese restrictions on rare-earth minerals essential for semiconductor manufacturing.

The convergence of these events appears to be part of a coordinated campaign. First, Microsoft and NVIDIA defined the new “agentic” software layer with the Copilot Fall Release (October 23) and new Azure AI Foundry offerings (October 28). Immediately following, NVIDIA announced a blitz of partnerships embedding its hardware as the de facto standard for strategic verticals (Enterprise, Telecom, Mobility) and allied nations (South Korea, Germany). OpenAI then executed strategic diversification, publicly re-affirming its Microsoft alliance on October 28 before announcing the massive $38 billion AWS deal on November 3.