AI Paradox Weekly #5: The Great Compute Consolidation (October 22 – November 4, 2025)

- Home

- AI Paradox Weekly #5: The Great Compute Consolidation (October 22 – November 4, 2025)

The AI Paradox Weekly

October 22th – November 4th

The Great Compute Consolidation

Table of Contents

TL:DR The Essential Intel

When you are pressed for time - and just need the goods

- OpenAI executed strategic compute diversification with a $38 billion, 7-year AWS partnership, securing access to hundreds of thousands of NVIDIA GPUs. This move, announced November 3, breaks OpenAI’s dependence on Microsoft Azure and provides compute leverage just days after publicly re-affirming the Microsoft partnership on October 28.

- The “Agentic Enterprise” became the dominant strategic narrative as Microsoft and OpenAI launched coordinated product offensives. Microsoft’s Copilot Fall Release (October 23) introduced real-time task guidance, while new “App Builder” and “Workflows” frontier agents enable non-developers to create autonomous business process agents.

- NVIDIA consolidated its position as full-stack AI utility with GTC D.C. announcements spanning enterprise (Palantir partnership), government (DOE supercomputer with Oracle), telecom (6G AI-RAN stack), and mobility (Uber AV platform). The company’s stock surged 5.23% intraday on October 28, while Palantir jumped 5.4% following the partnership announcement.

- US-China trade tensions eased temporarily with a “trade reset” agreement pausing US tech export restrictions and Chinese rare-earth mineral controls. The deal reduces tariffs from 57% to 47% and suspends China’s export controls on critical materials for one year, providing immediate relief to the AI hardware supply chain.

- Anthropic executed global “Sovereignty and Safety” strategy opening offices in Tokyo (October 29) and Seoul (October 23), signing cooperation with Japan AI Safety Institute, launching Iceland’s national AI education pilot (November 4), and unveiling “Advancing Claude for Financial Services” initiative (October 27). The company also expanded its Google Cloud partnership to secure TPU access, mirroring OpenAI’s multi-cloud diversification strategy.

Introduction: Coordinated Strategic Realignment

The past 14 days (October 22 – November 4, 2025) have been defined by a significant and coordinated strategic realignment among the industry’s largest players. The market’s focus has decisively pivoted from theoretical model capability to the commercial deployment of autonomous, enterprise-grade AI agents.

This shift was enabled and accelerated by three dominant, interlocking trends observed during this period:

1. The “Agentic Enterprise” Offensive: Market leaders, particularly Microsoft and OpenAI, launched a coordinated product offensive focused on “agentic” AI. This represents a move beyond simple chatbots to proactive, autonomous systems designed to execute complex business workflows, create applications, and manage high-value enterprise tasks.

2. The Great Compute Consolidation: A massive concentration of capital and strategic alliances solidified around key infrastructure providers. This was headlined by OpenAI securing a $38 billion cloud deal with Amazon Web Services (AWS), strategically diversifying its compute dependency beyond Microsoft. Simultaneously, NVIDIA’s GTC D.C. keynote unveiled a series of national-scale partnerships, positioning it as the full-stack, “sovereign AI” utility for entire industries and nations.

3. The Geopolitical “Trade Pause”: A significant, if temporary, de-escalation in the US-China technology trade war was finalized. This “trade reset” provides critical relief for the global AI supply chain, pausing US restrictions on tech exports and, crucially, Chinese restrictions on rare-earth minerals essential for semiconductor manufacturing.

The convergence of these events appears to be part of a coordinated campaign. First, Microsoft and NVIDIA defined the new “agentic” software layer with the Copilot Fall Release (October 23) and new Azure AI Foundry offerings (October 28). Immediately following, NVIDIA announced a blitz of partnerships embedding its hardware as the de facto standard for strategic verticals (Enterprise, Telecom, Mobility) and allied nations (South Korea, Germany). OpenAI then executed strategic diversification, publicly re-affirming its Microsoft alliance on October 28 before announcing the massive $38 billion AWS deal on November 3.

Section 1: The New Stack - Platform Wars and Mega-Partnerships

OpenAI's Compute Diversification Strategy

OpenAI’s actions signal a clear move to mitigate its dependency on Microsoft, its primary investor and partner.

COMPANY ANNOUNCEMENT: OpenAI Secures $38B in Compute from AWS, Diversifying from Microsoft Azure

- Sources: OpenAI News, Silicon Republic

- Publication Time: November 3, 2025 (OpenAI) and November 4, 2025 (Silicon Republic)

- Key Details:

- A multi-year, 7-year strategic partnership valued at $38 billion

- OpenAI will access AWS compute, including “hundreds of thousands” of NVIDIA GPUs (GB200, GB300) and “tens of millions” of CPUs

- The deal is explicitly intended to run and scale OpenAI’s AI workloads, specifically for agentic AI and training next-generation models

- Why Notable: This is a seismic strategic move, mitigating OpenAI’s existential risk of being solely dependent on Microsoft Azure. It provides compute leverage, supply chain redundancy, and prevents “platform capture” by a single partner that is also a direct competitor.

COMPANY ANNOUNCEMENT: OpenAI and Microsoft Re-affirm Partnership Amidst Shifting Cloud Alliances

- Source: OpenAI News

- Publication Time: October 28, 2025

- Key Details:

- A corporate blog post announcing “The next chapter of the Microsoft–OpenAI partnership”

- The post re-affirmed the companies’ joint mission and partnership

- Why Notable: The timing of this post is critical. It was released simultaneously with NVIDIA’s GTC D.C. keynote and just days before the $38B AWS deal became public. This appears to be a strategic “relationship-smoothing” communication to publicly re-state the alliance before announcing a massive deal with Microsoft’s biggest cloud competitor.

COMPANY ANNOUNCEMENT: OpenAI Acquires ‘Software Applications Inc.’ to Boost Agentic Capabilities

- Sources: PitchBook News, Radical Data Science

- Publication Time: October 23-24, 2025

- Key Details:

- Acquisition of Software Applications Inc., a 12-person startup

- The startup was founded by former Apple engineers who helped build the iPhone’s “Shortcuts” app

- The acquisition is seen as a “talent acquisition” to enhance ChatGPT’s ability to handle complex, computer-based tasks

- Why Notable: This is a pure “acqui-hire” for talent in agentic orchestration and on-device task automation. It signals OpenAI’s intent to move beyond chat and build a true “super-assistant” that can perform multi-step tasks on a user’s device, directly supporting the enterprise agent strategy.

Anthropic's Global and Vertical Expansion

Anthropic’s activity demonstrates a clear “Sovereignty and Safety” (S&S) go-to-market strategy. While OpenAI focuses on raw scale, Anthropic is building a brand of “trust” to capture key governments and regulated industries.

COMPANY ANNOUNCEMENT: Anthropic and Iceland Announce National AI Education Pilot

- Source: Anthropic Newsroom

- Publication Time: November 4, 2025

- Key Details:

- Anthropic is partnering with the government of Iceland

- The partnership will launch one of the “world’s first national AI education pilots”

- Why Notable: This is a major “soft power” and market-building move. By embedding itself at the national curriculum level, Anthropic is building generational loyalty and positioning “Claude” as a safe, educational tool, contrasting with ChatGPT’s more “wild-west” public perception.

COMPANY ANNOUNCEMENT: Anthropic Opens Tokyo Office, Signs Pact with Japan AI Safety Institute

- Source: Anthropic Newsroom

- Publication Time: October 29, 2025

- Key Details:

- Anthropic officially opened its Tokyo office

- The company signed a Memorandum of Cooperation with the Japan AI Safety Institute

- Why Notable: This move establishes a strong foothold in Asia and reinforces the “safety” brand, using regulatory alignment as a key market differentiator to gain access to the Japanese market.

COMPANY ANNOUNCEMENT: Anthropic Launches “Advancing Claude for Financial Services” Initiative

- Source: Anthropic Newsroom

- Publication Time: October 27, 2025

- Key Details:

- Announcement of a focused initiative to tailor and advance the Claude model for the financial services industry

- Why Notable: This is the commercial payoff for the S&S strategy. The “safety” halo cultivated with governments (Japan, Iceland) is immediately leveraged to enter a highly-regulated, high-margin vertical.

COMPANY ANNOUNCEMENT: Anthropic Expands Google Cloud Partnership, Securing TPU Access

- Source: Anthropic Newsroom

- Publication Time: October 23, 2025

- Key Details:

- Anthropic announced an expansion of its use of Google Cloud TPUs and Services

- Why Notable: This move mirrors OpenAI’s multi-cloud strategy. By balancing its compute dependencies between Google (TPUs) and Amazon (AWS), Anthropic ensures it cannot be throttled or controlled by any single one of its major cloud backers.

COMPANY ANNOUNCEMENT: Anthropic Opens Seoul Office, Third in Asia-Pacific

- Source: Anthropic Newsroom

- Publication Time: October 23, 2025

- Key Details:

- Anthropic announced the opening of its Seoul, South Korea office

- This is the company’s third office in the Asia-Pacific region

- Why Notable: Paired with the Tokyo office, this signals an aggressive expansion into key US-allied, high-tech industrial economies, targeting major manufacturing and technology conglomerates.

Section 2: Product & Commercial Offensive - The Rise of Agentic Systems

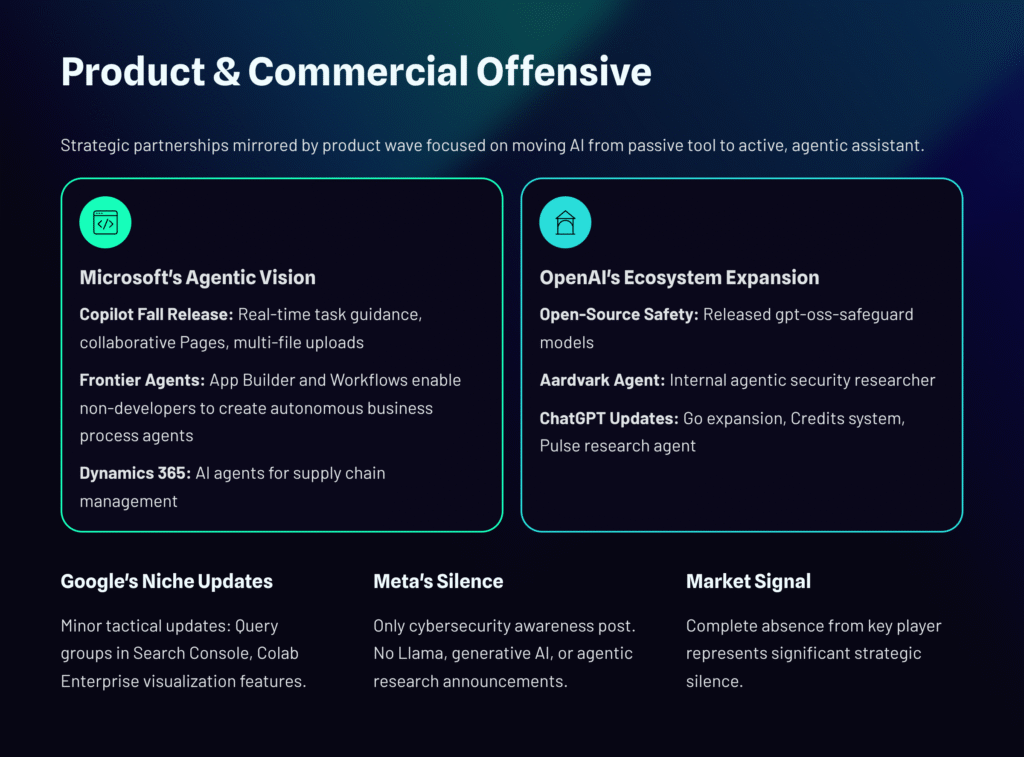

The strategic partnerships detailed above were mirrored by a wave of product announcements focused on moving AI from a passive tool to an active, agentic assistant. The activity from Microsoft and OpenAI was intense, while Google and Meta were comparatively quiet.

Microsoft's "Agentic" Copilot Vision

Microsoft’s announcements, led by its new AI CEO Mustafa Suleyman, center on transforming Copilot from a reactive chat window into a proactive, autonomous assistant.

COMPANY ANNOUNCEMENT: Human-centered AI: Microsoft Drops the Copilot Fall Release

- Source: Microsoft Copilot Blog

- Publication Time: October 23, 2025

- Key Details:

- Authored by Mustafa Suleyman, CEO of Microsoft AI, this post outlines the “Copilot Fall Release”

- New features include a “Copilot home” to resume recent files and conversations, and “Copilot Vision” to guide users through tasks in real-time

- “Pages,” Microsoft’s collaborative canvas, now supports multi-file uploads

- Why Notable: This is Suleyman’s first major release, cementing his vision for a “more personal, useful” AI. The focus on “guiding you through tasks in real time” is a clear pivot to an agentic, persistent assistant that understands user context.

COMPANY ANNOUNCEMENT: Microsoft 365 Copilot Now Enables Building Apps and Workflows

- Source: Microsoft AI Blog

- Publication Time: October 28, 2025

- Key Details:

- Microsoft is “bringing AI-powered building to employees across the organization”

- The launch includes new “Frontier agents” for Microsoft 365 Copilot customers, named “App Builder” and “Workflows”

- Why Notable: This is the commercial-enterprise component of the “Agentic” push. “App Builder” and “Workflows” are tools designed to let non-developers create autonomous agents that execute business processes, placing Microsoft in direct competition with agent-orchestration platforms.

COMPANY ANNOUNCEMENT: Microsoft Dynamics 365 Highlights AI Agents for Supply Chain

- Source: Microsoft AI Blog

- Publication Time: October 30, 2025

- Key Details:

- A blog post titled “3 ways to navigate changing tariffs with AI agents”

- Details how an AI agent can monitor trade updates, automate compliance checks, and adapt supply chains in real-time

- Why Notable: This is a content-marketing “case study” that explicitly ties Microsoft’s new agentic platform to a high-value, complex enterprise problem (supply chain management), which was a major news topic due to the concurrent US-China trade talks.

OpenAI's Product Ecosystem Expansion

OpenAI’s product updates focused on safety, security, and a three-pronged commercial strategy to expand market, monetize usage, and advance its agentic capabilities.

COMPANY ANNOUNCEMENT: OpenAI Releases ‘gpt-oss-safeguard’ Open-Source Models

- Source: OpenAI News

- Publication Time: October 29, 2025

- Key Details:

- OpenAI released two new open-source models: gpt-oss-safeguard-120b and gpt-oss-safeguard-20b

- A technical report was released detailing their performance and safety evaluations

- Why Notable: This is a strategic open-source release. It provides a “safe” baseline for the open-source community (appeasing regulators), while simultaneously becoming a new standard that hardware companies (like Groq) immediately adopt, further embedding OpenAI’s architecture in the wider ecosystem.

COMPANY ANNOUNCEMENT: OpenAI Deploys ‘Aardvark,’ an Agentic AI Security Researcher

- Source: OpenAI News

- Publication Time: October 30, 2025

- Key Details:

- OpenAI introduced “Aardvark,” an internal AI agent

- Aardvark’s purpose is to act as an “agentic security researcher” to help secure OpenAI’s systems

- Why Notable: This demonstrates the “agents building agents” paradigm. OpenAI is using its own advanced AI to secure its AI, creating a compounding feedback loop in security and capability that will be difficult for competitors to match.

COMPANY ANNOUNCEMENT: ChatGPT Updates: ‘Go’ Expansion, ‘Credits’ for Sora/Codex, and ‘Pulse’ Agent

- Source: ChatGPT Release Notes

- Publication Time: October 29-30, 2025

- Key Details:

- Market Expansion: ChatGPT Go (low-cost plan) expanded to 8 new EU countries (Austria, Denmark, Spain, etc.)

- Monetization: A new “Credits” system was introduced for flexible, pay-as-you-go usage of high-demand products like Codex and Sora

- Product Upgrade: “ChatGPT Pulse,” an asynchronous research agent, began rolling out to Pro users on web and Atlas

- Why Notable: This is a multi-pronged commercial strategy. “Go” captures lower-margin users, “Credits” creates a new granular revenue stream for premium services, and “Pulse” directly advances the “agent” paradigm, turning ChatGPT from a “live” tool to an autonomous researcher that “works on your behalf.”

Google's Niche Product Updates

In contrast to the massive platform and agentic announcements from Microsoft and OpenAI, Google’s activity in this 14-day window was minor, tactical, and focused on niche user bases.

COMPANY ANNOUNCEMENT: Google Introduces “Query groups” in Search Console Insights

- Source: Google Search Central News

- Publication Time: October 27, 2025

- Key Details:

- A new feature for the Google Search Console Insights tool

- Automatically groups similar search queries to help site owners analyze search performance data

- Why Notable: An iterative, minor update for its search and webmaster vertical.

COMPANY ANNOUNCEMENT: Google Cloud Enhances Colab Enterprise with No-Code Visualization

- Source: Google Cloud Blog

- Publication Time: October 24, 2025 (Week of Oct 20-24)

- Key Details:

- A new “Dataframe visualization” feature was added to Colab Enterprise

- Allows users to create custom visualizations from DataFrames without writing code

- Why Notable: A quality-of-life improvement for data scientists on its cloud platform, but not a major strategic AI launch.

Meta's AI-Adjacent Updates

COMPANY ANNOUNCEMENT: Meta Posts Cybersecurity Awareness Month Update

- Source: Meta Newsroom

- Publication Time: October 22, 2025

- Key Details:

- Meta published a blog post about “Helping Older Adults Avoid Online Scams”

- The post was part of Cybersecurity Awareness Month

- Why Notable: This post, while AI-adjacent (scams can use AI), is notable as it was the only verified announcement from Meta’s newsroom in the timeframe. The complete absence of news related to Llama, generative AI, or agentic research during this highly active 14-day period represents a significant silence from a key industry player.

Section 3: The Hardware Battlefield - GTC, Blueprints, and Sovereign AI

NVIDIA's GTC D.C. Platform Dominance

NVIDIA’s announcements on October 28, followed by a series of international partnership deals, represent a masterclass in vertical and horizontal integration. The company is no longer just selling GPUs; it is selling turnkey, gigawatt-scale “AI factories” and positioning itself as a geopolitical utility essential for national “AI sovereignty.”

This strategy was executed in three phases during the reporting period:

Phase 1: Announce the Foundational Layer (The “OS” and “Blueprint”)

HARDWARE ANNOUNCEMENT: NVIDIA Launches BlueField-4, “The Processor Powering the Operating System of AI Factories”

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- Announcement of the BlueField-4 processor

- Positioned as the core component for a new class of infrastructure required to handle “trillion-token workloads”

- Why Notable: This moves NVIDIA’s strategic narrative up the stack from a component (GPU) to the core processor (DPU) that manages the entire AI factory, akin to an “operating system” for the data center.

HARDWARE ANNOUNCEMENT: NVIDIA Launches Omniverse DSX Blueprint for “Gigawatt-Scale AI Factories”

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- NVIDIA founder and CEO Jensen Huang introduced NVIDIA Omniverse DSX

- It is a comprehensive, “open blueprint” for designing and operating gigawatt-scale AI factories

- Why Notable: By open-sourcing the blueprint for an AI factory, NVIDIA is standardizing the design of next-generation data centers around its own hardware and software ecosystem, making its stack the default architecture.

Phase 2: Secure Key Strategic Verticals (The “Anchor Tenants”)

HARDWARE ANNOUNCEMENT: Palantir and NVIDIA Team Up to Operationalize AI for Enterprise Data

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- A collaboration to build a “first-of-its-kind integrated technology stack for operational AI”

- The stack will include analytics, reference workflows, and automation to turn enterprise data into “dynamic decision intelligence”

- Why Notable: This partnership locks in the lucrative “agentic enterprise” data vertical, pairing NVIDIA’s hardware with Palantir’s “AIP” software platform, which is already deeply embedded in government and large corporations.

HARDWARE ANNOUNCEMENT: NVIDIA and Oracle to Build US Department of Energy’s Largest AI Supercomputer

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- A “landmark collaboration” with Oracle

- The partnership will build the U.S. Department of Energy (DOE)’s largest AI supercomputer to “dramatically accelerate scientific discovery”

- Why Notable: This secures the strategic “big science” and high-performance computing (HPC) vertical, establishing NVIDIA’s new stack as the standard for sovereign scientific research.

HARDWARE ANNOUNCEMENT: NVIDIA and US Telecom Leaders Unveil “All-American AI-RAN Stack” for 6G

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- America’s first “AI-native wireless stack for 6G”

- A collaboration with industry leaders including Booz Allen, Cisco, MITRE, ODC, and T-Mobile

- Why Notable: This move captures the next generation of telecommunications infrastructure, ensuring that NVIDIA’s technology is at the core of 6G development and deployment.

HARDWARE ANNOUNCEMENT: NVIDIA and Uber Partner to Scale Robotaxi Network

- Source: NVIDIA Newsroom

- Publication Time: October 28, 2025

- Key Details:

- Partnership with Uber to scale the “world’s largest level 4-ready mobility network”

- Uber will utilize the new NVIDIA DRIVE AGX Hyperion 10 autonomous vehicle (AV) platform

- Why Notable: This deal locks in a leader in the autonomous mobility vertical, securing a massive, long-term customer for NVIDIA’s specialized DRIVE platform.

Phase 3: Replicate at National Scale (The “Sovereign AI” Model)

HARDWARE ANNOUNCEMENT: NVIDIA Partners with South Korea Government and Industrial Giants (Samsung, SK, Hyundai)

- Source: NVIDIA Newsroom

- Publication Time: October 30, 2025

- Key Details:

- A series of announcements to build South Korea’s sovereign AI infrastructure

- Includes expanding to over 250,000 NVIDIA GPUs across sovereign clouds and AI factories

- Specific “AI factory” deals were announced with Samsung (intelligent manufacturing), SK Group (semiconductor R&D), and Hyundai (AI-driven mobility)

- Why Notable: This is the “Sovereign AI” playbook in action. NVIDIA is not just selling to companies; it is becoming the core infrastructure partner for an entire nation’s industrial and technology strategy.

HARDWARE ANNOUNCEMENT: Deutsche Telekom and NVIDIA Launch “Industrial AI Cloud” for Germany

- Source: NVIDIA Newsroom

- Publication Time: November 4, 2025

- Key Details:

- Unveiled the “world’s first Industrial AI Cloud” in Berlin

- A “sovereign, enterprise-grade platform” scheduled to go live in early 2026

- Combines Deutsche Telekom’s trusted infrastructure with NVIDIA’s full AI stack

- Why Notable: This replicates the sovereign AI model for Germany, Europe’s largest industrial economy. It specifically targets the “Industrial” vertical, positioning NVIDIA as the platform for Germany’s “Industrial Transformation.”

The Accelerator Vanguard (Specialized Hardware)

While NVIDIA dominated the “AI factory” narrative, specialized hardware companies made key moves to capture high-performance niches, particularly in low-latency inference.

HARDWARE ANNOUNCEMENT: Groq Powers HUMAIN One, a Real-Time AI Operating System

- Source: Groq Newsroom

- Publication Time: October 28, 2025

- Key Details:

- Groq’s LPU (Language Processing Unit) was selected by HUMAIN to power “HUMAIN One,” a new enterprise OS

- HUMAIN One is a voice-based interface that uses intelligent agents to complete tasks, requiring the extreme low-latency inference that Groq’s LPU provides

- Why Notable: This is a major design win for Groq. It validates their “inference-first” architecture as the critical enabler for real-time, agentic systems—a domain where traditional GPUs, optimized for training, may falter.

HARDWARE ANNOUNCEMENT: Groq Announces Day Zero Support for OpenAI’s Open Safety Model

- Source: Groq Blog

- Publication Time: October 22, 2025

- Key Details:

- Groq’s platform offered immediate “Day Zero Support” for OpenAI’s new gpt-oss-safeguard model

- Why Notable: This demonstrates agility and strategic alignment. By immediately supporting OpenAI’s latest open-source standard, Groq makes its specialized hardware an easy-to-adopt, high-performance alternative for developers already in the OpenAI ecosystem.

HARDWARE ANNOUNCEMENT: Cerebras Details “Instant RL Loops” with Meta Llama Tools

- Source: Cerebras Blog

- Publication Time: October 27, 2025

- Key Details:

- A technical blog post, “Building Instant RL Loops with Meta Llama Tools and Cerebras”

- Details how its wafer-scale architecture can be used for Reinforcement Learning (RL)

- Why Notable: Like Groq, Cerebras is positioning its unique architecture as ideal for a specialized, high-performance niche. “RL loops” are compute-intensive and critical for training advanced agents, marking this as a pitch for the R&D and model-training market.

HARDWARE ANNOUNCEMENT: Axelera AI Launches “Smarter Spaces Project Challenge”

- Source: Axelera AI Community

- Publication Time: October 30, 2025

- Key Details:

- A project challenge launched in partnership with Orange Pi

- The challenge encourages developers to build “Smarter Spaces” solutions using Axelera’s edge AI hardware

- Why Notable: This is a community-building and ecosystem-development play for the edge AI market. It targets the developer and maker communities to drive adoption, a space distinct from the massive “AI factory” battle.

Section 4: Financial Markets and Geopolitical Developments

This section analyzes the market movements and geopolitical landscape that provide the financial and legal context for the industry’s developments.

Geopolitical Tech Accord: The US-China "Trade Reset"

The most significant macro development of the period was the finalization of a trade truce between the US and China, which directly impacts the entire AI hardware supply chain.

REGULATORY & POLICY: US-China “Trade Reset”: Nations Agree to Pause Tariffs and Export Controls

- Sources: China Briefing, Times of India

- Publication Time: Circa October 27 – November 1, 2025 (Deal finalized following Trump-Xi meeting in Busan and confirmed by White House)

- Key Details:

- The US agreed to cut tariffs on certain Chinese imports, bringing the overall average rate down from 57% to 47%

- China agreed to suspend for one year its new export controls on rare-earth minerals and magnets, which are critical for AI chips and defense

- The US agreed to pause its planned one-year expansion of its tech export blacklist

- Why Notable: This is a major de-escalation that provides immediate, tangible relief to the AI hardware supply chain. It signals a shift from “ideological decoupling” to “pragmatic coexistence,” driven by mutual economic pain. This directly benefits NVIDIA, AMD, Intel, and every data center manufacturer by stabilizing critical-supply and -demand chains.

AI Market Volatility & Capital

The strategic announcements from industry leaders had an immediate and significant impact on public markets, while private capital continued to flow into “picks and shovels” infrastructure plays.

BUSINESS & FINANCIAL: NVIDIA (NVDA) Stock Surges >5% on GTC D.C. Keynote

- Source: NASDAQ Historical Data

- Publication Time: October 28, 2025

- Key Details:

- On the day of its GTC D.C. keynote, NVDA stock opened at $193.05

- The stock rallied during the day’s trading, hitting a high of $203.15, marking a 5.23% intraday gain before closing at $201.03

- Why Notable: This is a direct, causal link between NVIDIA’s strategic announcements (Palantir, Oracle, Uber, AI-RAN) and a significant, positive market re-valuation, confirming strong investor buy-in to its “AI factory” strategy.

BUSINESS & FINANCIAL: Palantir (PLTR) Stock Jumps >5% Following NVIDIA Partnership

- Source: NASDAQ Historical Data

- Publication Time: October 28, 2025

- Key Details:

- On the day of its GTC D.C. keynote, NVDA stock opened at $193.05

- The stock rallied during the day’s trading, hitting a high of $203.15, marking a 5.23% intraday gain before closing at $201.03

- Why Notable: This is a direct, causal link between NVIDIA’s strategic announcements (Palantir, Oracle, Uber, AI-RAN) and a significant, positive market re-valuation, confirming strong investor buy-in to its “AI factory” strategy.

BUSINESS & FINANCIAL: Palantir (PLTR) Stock Jumps >5% Following NVIDIA Partnership

- Source: NASDAQ Historical Data

- Publication Time: October 29, 2025

- Key Details:

- Following the October 28 partnership announcement with NVIDIA, PLTR stock opened at $191.08

- The stock hit a high of $199.85, representing a 5.4% intraday gain

- Why Notable: This demonstrates the “NVIDIA halo effect.” The partnership was perceived by the market as a massive validation of Palantir’s “AIP” (Artificial Intelligence Platform), cementing its role in the new “agentic enterprise” stack.

BUSINESS & FINANCIAL: Palantir (PLTR) Rallies to 52-Week High on Q3 Earnings

- Sources: NASDAQ Historical Data, Macrotrends

- Publication Time: November 3, 2025

- Key Details:

- Palantir reported Q3 2025 income after hours on November 3

- In anticipation, the stock closed at $207.18 (a +3.04% gain for the day), its all-time high closing price

- Why Notable: While the single-day close was not >5%, the event was driven by enthusiasm for its AI-driven growth (validated by the NVIDIA deal) and pushed the stock to a new record, confirming strong market momentum.

BUSINESS & FINANCIAL: Crusoe Energy Systems Raises $1.38B Series E, Backed by NVIDIA

- Source: HackerNoon

- Publication Time: Week of October 20-25, 2025

- Key Details:

- Crusoe Energy Systems raised a $1.38 billion Series E round at a $10 billion valuation

- Investors include Valor Equity Partners, Mubadala Capital, NVIDIA, Founders Fund, and Tiger Global

- Why Notable: This is a massive funding round for an AI infrastructure company, not a model builder. Crusoe, which powers data centers with stranded natural gas (flared gas), represents a crucial “picks and shovels” play. NVIDIA’s participation as an investor validates this “energy-first” approach to building AI compute, acknowledging that power generation is a primary bottleneck.

BUSINESS & FINANCIAL: Y Combinator Funds AI Startup ‘Flai’

- Source: Revli

- Publication Time: October 2025

- Key Details:

- AI startup “Flai” is listed as having received recent funding in October 2025

- Flai is part of the Y Combinator (YC) portfolio

- Why Notable: Represents continued seed-stage investment in new AI-native companies, even as late-stage funding consolidates around massive infrastructure plays.

Section 5: The Open Frontier — Research, Repositories, and Academia

Academia Sounds the Alarm

RESEARCH & TECHNICAL: Stanford HAI: “Universities Must Reclaim AI Research for the Public Good”

- Source: Stanford HAI News

- Publication Time: October 30, 2025

- Key Details:

- An article authored by Stanford HAI leaders, including John Etchemendy, James Landay, Fei-Fei Li, and Christopher Manning

- The piece argues that as “corporate AI labs turning inward, academia must carry forward the mantle of open science”

- Why Notable: This is a direct, public response to the “Great Compute Consolidation” and the trend of closed-model development. Academia is officially warning that corporate “closed” science threatens public-good research. This is a foundational “call to arms” for the open-source community, positioning universities as the bastion against total corporate capture of AI.

Key Academic and Research Lab Publications

RESEARCH & TECHNICAL: Google’s DeepMind Details October Research in Science and Safety

- Source: Google DeepMind

- Publication Time: October 2025 (Multiple posts)

- Key Details:

- “Accelerating discovery with the AI for Math Initiative”

- “Bringing AI to the next generation of fusion energy”

- “Introducing CodeMender: an AI agent for code security”

- “Introducing the Gemini 2.5 Computer Use model”

- Why Notable: This shows DeepMind’s continued focus on “Science & Safety” verticals. While Microsoft is shipping enterprise agents, Google is publishing foundational research on math, fusion, science, and code security, reinforcing its brand as a fundamental research organization.

RESEARCH & TECHNICAL: Microsoft Security Researchers Discover “SesameOp” Backdoor

- Source: Microsoft Security Blog

- Publication Time: November 3, 2025

- Key Details:

- Microsoft DART researchers uncovered a novel backdoor named “SesameOp”

- The malware “uses the OpenAI Assistants Application Programming Interface (API) as a mechanism for command-and-control (C2)” communications

- Why Notable: A critical security finding that demonstrates how AI APIs themselves are a new, novel “attack surface” for sophisticated threat actors, moving beyond traditional C2 channels.

RESEARCH & TECHNICAL: MIT Research Highlights: Sustainable AI, K-12 Education, and Vulnerable Ecosystems

- Source: MIT News

- Publication Time: October 24 – November 3, 2025

- Key Details:

- “Helping K-12 schools navigate the complex world of AI” (Nov 3)

- “3 Questions: How AI is helping us monitor and support vulnerable ecosystems” (Nov 3)

- “The brain power behind sustainable AI” (Oct 24), exploring energy-efficient computing inspired by the human brain

- Why Notable: These publications show a strong academic focus on the societal and environmental impact of AI, including education, ecology, and energy efficiency—a direct counterpoint to the industry’s “gigawatt-scale” build-out.

RESEARCH & TECHNICAL: Stanford HAI Publishes Research on Medical AI Platforms and Child Speech Services

- Source: Stanford HAI News

- Publication Time: October 22 – 27, 2025

- Key Details:

- “How To Build a Safe, Secure Medical AI Platform (ChatEHR)” (Oct 22), a privacy-preserving tool for health systems

- “Using AI to Streamline Speech and Language Services for Children” (Oct 27)

- Why Notable: Aligns with the “AI for Public Good” theme, focusing on high-trust, regulated verticals like healthcare and child services.

RESEARCH & TECHNICAL: Carnegie Mellon University Announces AI-Driven Team Coach, Amazon Fellows

- Source: CMU Engineering News

- Publication Time: October 22 – 31, 2025

- Key Details:

- “AI Coach is changing the way teams perform for better results” (Oct 31), a tool backed by psychology-informed AI

- “Engineering students among Amazon AI Ph.D. Fellows” (Oct 22)

- Why Notable: The “AI Coach” demonstrates the application of AI to human-computer interaction and team dynamics, while the Amazon fellowships show the tight integration and “brain drain” between top-tier academia and industry giants.

The Open-Source Front: GitHub and HuggingFace

RESEARCH & TECHNICAL: GitHub “Octoverse” Report: AI and Agents Drive Biggest Shift in a Decade

- Source: GitHub Blog

- Publication Time: October 28, 2025

- Key Details:

- GitHub’s 2025 Octoverse report states “AI, agents, and typed languages are driving the biggest shifts in software development”

- Over 1.1 million public repositories now use an LLM SDK, a +178% increase year-over-year

- For the first time, TypeScript has overtaken both Python and JavaScript as the most-used language on the platform

- Why Notable: This provides hard data confirming the “Agentic Enterprise” trend. The shift to TypeScript (a typed language) is particularly significant, signaling a maturation from “hobbyist” Python scripting to “enterprise-grade” development that requires more robust, secure, and scalable code.

Impactful ArXiv Papers

RESEARCH & TECHNICAL: ArXiv Paper Benchmarks AI Agent Risk in “High-Stakes Adversarial Financial Markets”

- Source: ArXiv

- Publication Time: Submitted circa October 28-31, 2025

- Key Details:

- Paper Title: “When Hallucination Costs Millions: Benchmarking AI Agents in High-Stakes Adversarial Financial Markets”

- The paper (arXiv:2510.00332) benchmarks the performance and risk of AI agents in simulated financial markets

- Why Notable: This paper directly addresses the primary risk of the “Agentic Enterprise.” As Anthropic (Oct 27) and Microsoft push AI agents into finance and enterprise workflows, this academic research provides a timely, critical benchmark of the extreme financial risks (e.g., from “hallucinations”) of deploying autonomous agents in high-stakes environments.

RESEARCH & TECHNICAL: ArXiv Paper Proposes “Continuous Autoregressive Language Models”

- Source: ArXiv

- Publication Time: Submitted November 3, 2025

- Key Details:

- Paper Title: “Continuous Autoregressive Language Models” (arXiv:2510.27688)

- Proposes a new model architecture

- Why Notable: Represents new, foundational research into core LLM architectures, which could influence future generations of models.

Section 6: Industry Pulse and Trending Content

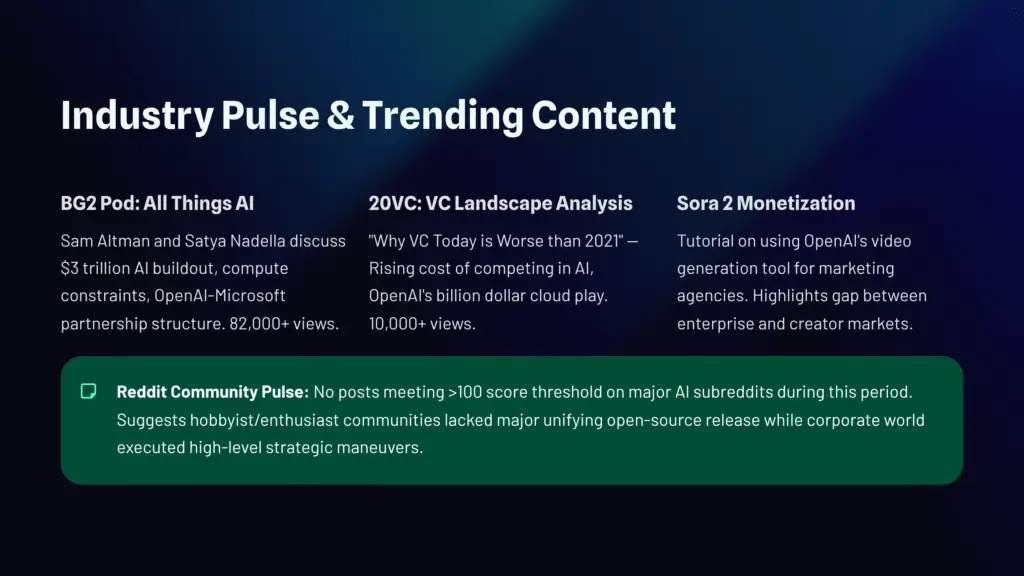

Key Industry Commentary (YouTube)

TRENDING CONTENT: “All things AI w @altcap @sama & @satyanadella. A Halloween Special.”

- Source: YouTube – BG2 Pod

- Publication Time: Circa October 31, 2025

- Key Details:

- A long-form interview on the BG2 Pod with Sam Altman (CEO, OpenAI) and Satya Nadella (CEO, Microsoft), hosted by Brad Gerstner

- Views: 82,000+

- Discussion topics included the “$3 trillion AI buildout,” “compute constraints and scaling,” and the structure of the OpenAI-Microsoft partnership

- Why Notable: This is a primary source strategic document, not just an interview. Released during their week of massive announcements, this was a coordinated “investor relations” push. Altman and Nadella’s direct discussion of “compute constraints” and “revenue sharing” provides the direct “why” for OpenAI’s $38B AWS deal and NVIDIA’s GTC partnerships, which are all aimed at solving this exact compute bottleneck.

TRENDING CONTENT: 20VC: “Why VC Today is Worse than 2021”

- Source: YouTube – 20VC

- Publication Time: Circa October 25, 2025

- Key Details:

- A 20VC podcast episode featuring venture capitalists

- Views: 10,000+

- Topics included the “rising cost of competing in AI” and “OpenAI’s billion dollar cloud play”

- Why Notable: This provides the VC-level perspective, confirming that the “Great Compute Consolidation” is making it prohibitively expensive for new startups to compete at the foundation-model layer. This reinforces the bifurcation of the market into a few “platform” owners and many “application-layer” startups.

TRENDING CONTENT: “how to set up and use SORA 2 (to make money)”

- Source: YouTube

- Publication Time: Circa October 23, 2025

- Key Details:

- A YouTube tutorial explaining how to use OpenAI’s Sora 2 video generation tool to create content for a marketing agency

- Views: 10,000+

- Why Notable: While industry leaders are focused on “agentic workflows,” the public and creator-economy discourse is still centered on content-generation-for-profit. This highlights a gap between the high-end enterprise market and the broad “creator” market, which is now being monetized by OpenAI’s new “Credits” system for Sora.

Conclusion: Forward Outlook

The October 22 – November 4, 2025 period represents a coordinated strategic shift in the AI industry. The convergence of three major trends – the agentic enterprise offensive, compute consolidation, and geopolitical de-escalation – signals that the market is transitioning from a “capability race” to a “deployment and scale race.”

Key strategic takeaways:

- Compute Independence is Now Strategic Priority: OpenAI’s $38B AWS deal and Anthropic’s multi-cloud strategy (Google TPUs + AWS) demonstrate that foundation model companies view compute sovereignty as an existential issue. Dependence on a single cloud provider is now understood as a critical vulnerability.

- The Agentic Layer is the New Battleground: Microsoft and OpenAI’s coordinated product offensive around “agents that execute tasks autonomously” represents the next value-capture layer beyond conversational AI. The shift from Python to TypeScript in GitHub repositories confirms this is a real, operational trend, not just marketing.

- NVIDIA’s Full-Stack Strategy is Succeeding: By moving from component (GPU) to platform (full AI factory blueprint) to geopolitical utility (sovereign AI for nations), NVIDIA has positioned itself as the indispensable infrastructure layer for the entire AI industry.

- Academia Recognizes Existential Threat: Stanford HAI’s public call for universities to “reclaim AI research for the public good” acknowledges that compute consolidation is excluding academic institutions from frontier research, threatening the open science model.

- Geopolitical Pragmatism Over Ideology: The US-China trade reset demonstrates that economic pain can overcome ideological posturing, at least temporarily. The one-year pause provides breathing room for the supply chain but does not resolve underlying strategic competition.

The next 6-12 months will determine whether the “agentic enterprise” vision translates into real ROI for enterprises, or whether it becomes another AI hype cycle. The early indicators – massive infrastructure investments, rapid product launches, and coordinated messaging – suggest this is a genuine strategic bet by the industry’s largest players.

Executive Summary & Governance Takeaways

The October 22 – November 4, 2025 period was defined by three interlocking strategic developments: a massive compute consolidation around key infrastructure providers, a coordinated “agentic enterprise” product offensive from Microsoft and OpenAI, and a temporary geopolitical de-escalation in US-China tech trade tensions.

OpenAI’s $38 billion AWS partnership represents the most significant strategic move, breaking its sole dependency on Microsoft Azure and securing compute independence. This was preceded by Microsoft’s Copilot Fall Release and NVIDIA’s GTC D.C. announcements, which together define the new “agentic AI” software and hardware stack.

NVIDIA’s strategy evolved from selling components to providing complete “AI factory” blueprints, securing anchor partnerships across enterprise (Palantir), government (DOE supercomputer), telecom (6G AI-RAN), and mobility (Uber AV). The company then replicated this model at national scale with South Korea and Germany, positioning itself as essential infrastructure for “sovereign AI.”

Anthropic executed a contrasting “Sovereignty and Safety” strategy, opening offices in Tokyo and Seoul, signing cooperation agreements with government AI safety institutes, and targeting regulated verticals like financial services. This approach builds a “trust” brand to differentiate from OpenAI’s scale-focused strategy.

The US-China trade reset provides temporary relief by reducing tariffs and suspending rare-earth export controls, acknowledging that mutual economic pain trumps ideological decoupling. However, this is a pause, not a resolution.

Governance & Compliance Takeaways

1. Agentic AI = New Accountability Framework Required

The shift from conversational AI to autonomous agents that execute multi-step workflows fundamentally changes the risk and accountability model. Organizations deploying “frontier agents” like Microsoft’s App Builder and Workflows must establish clear human oversight boundaries and decision authority frameworks. The NIST AI Risk Management Framework “GOVERN” function provides the foundational structure, but organizations need to develop agent-specific policies addressing:

- Decision Authority: Which actions can agents execute without human approval?

- Audit Trails: How do we log and audit agent decisions?

- Liability Assignment: When an agent makes an error or causes harm, who bears accountability?

The ArXiv paper benchmarking AI agents in financial markets demonstrates that hallucination risks in high-stakes environments can result in catastrophic financial losses. Governance programs must implement pre-deployment risk assessments for agentic systems in critical business functions.

2. Compute Sovereignty = Supply Chain Risk Management

OpenAI’s diversification to AWS and Anthropic’s multi-cloud strategy (Google TPUs + AWS) demonstrate that compute dependency is now recognized as an existential strategic risk. For enterprises building AI capabilities, this translates to:

- Vendor Concentration Risk: Single-provider dependency creates strategic vulnerability.

- Service Continuity Planning: Multi-cloud or hybrid architectures may be necessary for mission-critical AI systems that can’t tolerate downtime.

- Regulatory Compliance: Data residency and sovereignty requirements—especially under the EU AI Act and GDPR—may demand geographically distributed compute infrastructure across multiple jurisdictions.

Organizations should conduct formal risk assessments of their AI infrastructure dependencies and develop contingency strategies for compute continuity.

3. “Sovereign AI” = New Compliance Complexity

NVIDIA’s national-scale partnerships with South Korea and Germany demonstrate that AI is becoming critical infrastructure at the national level. For multinational organizations, this creates new compliance considerations:

- Data Localization: Increasing pressure to process sensitive data within national boundaries using “sovereign” infrastructure

- Technology Transfer Controls: Enhanced scrutiny of cross-border AI technology and model transfers

- Regulatory Fragmentation: Different nations implementing divergent AI governance frameworks (US innovation-focused vs. EU risk-based approach)

The temporary US-China trade reset demonstrates that geopolitical factors directly impact AI supply chains. Organizations must monitor export control developments and prepare for potential supply disruptions.

4. Safety Models as Compliance Tools

OpenAI’s release of gpt-oss-safeguard models and deployment of “Aardvark” security agent demonstrate that safety and security capabilities are becoming embedded in AI infrastructure itself. This creates new opportunities for compliance programs:

- Automated Safety Checks: Safety models can provide first-line filtering for harmful content or misuse

- Security Monitoring: Agentic security tools can augment human security teams

- Continuous Compliance: AI-powered monitoring for policy violations

However, organizations must ensure these automated tools are themselves subject to governance oversight, with clear escalation procedures when automated systems flag potential issues.

5. Academic Exodus = Talent and Research Risk

Stanford HAI’s public warning that corporate AI labs are threatening academic open science highlights a strategic risk: the concentration of AI capability in a handful of companies may create long-term talent and innovation constraints. Organizations should:

- Maintain Academic Partnerships: Continued collaboration with universities helps access cutting-edge research and diverse perspectives

- Support Open Research: Contributing to open-source projects and funding academic research builds long-term ecosystem health

- Develop Internal Expertise: As academic AI programs struggle with compute constraints, organizations must develop internal training and research capabilities

6. Microsoft’s Security Finding = API Attack Surface Awareness

The Microsoft Security discovery of “SesameOp” malware using OpenAI’s API for command-and-control demonstrates that AI APIs themselves are now attack vectors. Security teams must:

- Monitor AI API Usage: Unusual patterns of API calls may indicate compromise

- Implement Rate Limiting: Prevent abuse of AI APIs for malicious purposes

- Audit Third-Party Integrations: Applications using AI APIs should be subject to security review

7. EU AI Act Implementation Continues

While no major regulatory updates occurred during this period, the EU AI Act implementation timeline continues. Organizations must prepare for February 2, 2025 deadlines when prohibitions on “unacceptable risk” systems take effect. The deployment of agentic systems may trigger additional scrutiny under the Act’s “high-risk” categories, particularly in:

- Financial services (Anthropic’s financial services initiative will face compliance requirements)

- Employment decisions (if agents are used for hiring or workforce management)

- Critical infrastructure (NVIDIA’s industrial AI deployments)

Bottom Line

The AI industry has entered a new phase where strategic positioning, infrastructure control, and deployment-ready products matter more than raw model capability. Organizations that thrive in this environment will need to:

- Update their governance frameworks to handle autonomous agents making multi-step decisions

- Assess where they’re dependent on specific compute providers and build backup plans

- Watch geopolitical shifts that could disrupt AI supply chains and regulatory requirements

- Prepare for a world where different countries enforce very different AI rules

- Build internal AI capabilities as concentration in big companies threatens the academic research pipeline that’s historically trained talent

The next wave of AI value will be captured by organizations that successfully balance innovation velocity with robust governance frameworks aligned to standards like NIST AI RMF, ISO/IEC 42001, and the EU AI Act. The “agentic enterprise” is not a distant vision – it’s being deployed now, and governance must keep pace.

The past 14 days (October 22 – November 4, 2025) have been defined by a significant and coordinated strategic realignment among the industry’s largest players. The market’s focus has decisively pivoted from theoretical model capability to the commercial deployment of autonomous, enterprise-grade AI agents.

This shift was enabled and accelerated by three dominant, interlocking trends observed during this period:

1. The “Agentic Enterprise” Offensive: Market leaders, particularly Microsoft and OpenAI, launched a coordinated product offensive focused on “agentic” AI. This represents a move beyond simple chatbots to proactive, autonomous systems designed to execute complex business workflows, create applications, and manage high-value enterprise tasks.

2. The Great Compute Consolidation: A massive concentration of capital and strategic alliances solidified around key infrastructure providers. This was headlined by OpenAI securing a $38 billion cloud deal with Amazon Web Services (AWS), strategically diversifying its compute dependency beyond Microsoft. Simultaneously, NVIDIA’s GTC D.C. keynote unveiled a series of national-scale partnerships, positioning it as the full-stack, “sovereign AI” utility for entire industries and nations.

3. The Geopolitical “Trade Pause”: A significant, if temporary, de-escalation in the US-China technology trade war was finalized. This “trade reset” provides critical relief for the global AI supply chain, pausing US restrictions on tech exports and, crucially, Chinese restrictions on rare-earth minerals essential for semiconductor manufacturing.

The convergence of these events appears to be part of a coordinated campaign. First, Microsoft and NVIDIA defined the new “agentic” software layer with the Copilot Fall Release (October 23) and new Azure AI Foundry offerings (October 28). Immediately following, NVIDIA announced a blitz of partnerships embedding its hardware as the de facto standard for strategic verticals (Enterprise, Telecom, Mobility) and allied nations (South Korea, Germany). OpenAI then executed strategic diversification, publicly re-affirming its Microsoft alliance on October 28 before announcing the massive $38 billion AWS deal on November 3.